http://www.asyura2.com/19/senkyo257/msg/810.html

| Tweet |

社会主義は帰ってくるのか

21世紀によみがえる「大きな政府」

2019.2.22(金) 池田 信夫

バーニー・サンダース氏、20年米大統領選出馬に「脈あり」

米首都ワシントンで講演するバーニー・サンダース上院議員(2017年6月22日撮影、資料写真)。(c)Mandel Ngan / AFP〔AFPBB News〕

2020年に行われるアメリカの大統領選挙に、バーニー・サンダース上院議員が出馬を表明した。彼は2016年の大統領選挙で、ヒラリー・クリントン上院議員と最後まで民主党の候補を争ったことで知られる。彼の掲げる政策は、国民皆保険、全米最低賃金15ドル、公立学校の無償化など、巨額の財源を必要とする「大きな政府」である。

サンダースはみずから「民主社会主義者」と名乗り、民主党左派に大きな支持を集めている。社会主義は20世紀に崩壊し、過去のものになったと思われているが、サンダースを支持するのは、冷戦の終了後に生まれた若者だ。時代は一めぐりして、社会主義の時代がやってくるのだろうか。

財源の不明な「グリーン・ニューディール」

サンダースの選挙運動の中心になっているのが、アレクサンドリア・オカシオ=コルテス下院議員である。昨年(2018年)初当選したばかりでまだ29歳だが、彼女も民主社会主義者を名乗っている。

彼女は「グリーン・ニューディール」(GND)という大胆なエネルギー政策を提案して注目を集めた。これは「今後10年以内に全米のエネルギーを100%再生可能エネルギーに変える」という決議案で、ベーシック・インカム(すべての人に定額の所得を保障する)や国民皆保険などの「格差是正計画」も入っている。

この決議案には法的拘束力はないが、大統領候補に名乗りを上げた政治家のうち6人がこの決議案に署名した。こういう突飛な案が議会で議論される背景には、アメリカの格差が拡大している状況がある。アメリカでは所得の20%が人口の1%の富裕層に集中し、最貧層との格差が大きな社会問題になっている。

10年で全米の火力発電所や原子力発電所をすべて廃止して再エネに変えるには、年間3兆ドル(330兆円)以上のコストがかかるといわれる。ベーシック・インカムにも同じぐらいの財源が必要で、GNDのコストは連邦政府の予算をはるかに上回る。

その財源はどうするのだろうか。サンダースは金持ちの資産に「富裕税」をかけると主張し、オカシオ=コルテスは所得税の最高税率を70%に引き上げるというが、そんな大増税が簡単にできるとは思えない。そのとき財源はどうするのか。

政府の借金は紙幣を印刷してまかなう

紙幣を印刷すればいい、というのがオカシオ=コルテスの答である。これはMMT(modern monetary theory)というあやしげな経済理論で、「国債はお札を印刷してファイナンスできるので、財政は破綻しない」という。これが本当なら、増税しないで政府支出をいくらでも増やせる「フリーランチ」があることになる。

政府債務が増えると金利が上がり、それによって(元利合計した)政府債務が増え、それによって国債のリスクが高まり、それによって金利が上がる・・・という悪循環に入り、「財政インフレ」で政府債務が無限大に発散するというのが経済学の常識だ。

しかし今のような超低金利が今後もずっと続くとすれば、財政が破綻する心配はない。日本でも国債が増発され、日銀がそれを400兆円以上買っても金利は下がる一方で、最近は長期金利もほぼゼロという世界史に前例のない低水準である。

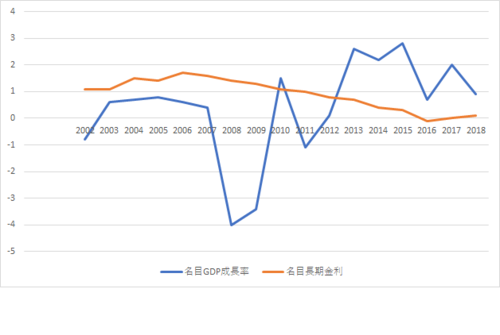

単純化していうと、名目金利が名目成長率を下回る限り、政府債務は発散しない。これは成長率が高いと税収の伸びが金利負担の伸びを上回るからだ。下の図のように2013年以降は金利が成長率より低いので、この状況が今後もずっと続くなら、フリーランチはありうる。

http://jbpress.ismedia.jp/mwimgs/6/f/500/img_6f8b492feed47a189cb61e3c1d8b42b013123.png

名目成長率と名目金利(%、内閣府調べ)

ゼロ金利はいつまで続くのか

財政が破綻しないとしても、今の世代が借金して将来世代がそれを返すのは、負担を子孫に先送りすることになるのではないか。これはもっともな疑問だが、国債のほとんどは日本国民が買うので、国民の資産でもある。国債がすべて相続されると将来世代の資産が増えるので、国民全体としては同じだ(所得分配は無視する)。

これは名目ベースの話で、実質的な負担は金利と成長率の関係によって違う。たとえば金利が1%だとすると、借金は20年後には元利合計で約1.2倍になるが、成長率が2%だとGDPは20年後には約1.5倍になる。つまり金利が成長率より低いと、将来世代の借金返済の負担(GDP比)は軽くなるので、いま借金して将来返したほうが国民全体として有利になるのだ。

逆に金利が成長率より高いと、将来世代の負担は重くなる。彼らの損失は、政府の借金が民間投資を押しのけることによって生じる資本蓄積の減少だから、金利(資本収益率)が成長率より低いときは、民間に代わって政府が投資することが効率的だ。直感的にいうと、ゼロ金利が今後もずっと続くなら貯金しても資産は増えないので、いま政府が使ったほうがいいのだ(*)。

これはアメリカでは重要な問題で、社会保障のインフラを政府が整備すべきかどうかについて長い論争がある。その財源を増税でまかなうことには共和党が反対しているので政治的に不可能だが、国債の増発は政治的には容易である。

ヨーロッパでも2010年代にEU(ヨーロッパ連合)が南欧諸国の財政危機を支援する条件として緊縮財政を強要したことに反発して「反緊縮」の運動が強まった。

日本では一足先に、安倍政権が「大きな政府」に舵を切った。日本の政府債務はGDP比で世界最悪だが、安倍首相は2度も増税を延期し、日銀が財政ファイナンスで国債を買い支えている。多くの経済学者は「国債が暴落する」と警告してきたが、実質金利はほぼゼロになった。何かが変わったのではないか、と主流の経済学者も考え始めた。

しかし何が変わったのか、原因は分からない。日本が2000年代にゼロ金利になったとき、世界の経済学者が日銀の金融政策を嘲笑したが、今は世界にゼロ金利が広がっている。これが今後も続くかどうかも分からないので、財政赤字を膨張させることは危険だが、「大きな政府か小さな政府か」についての論争には、まだ答が出ていないのである。

(*)この話はいろいろな条件を単純化しているので、厳密な議論は今年1月のアメリカ経済学会長講演を読んでいただきたい。

http://jbpress.ismedia.jp/articles/-/55571

https://www.aeaweb.org/aea/2019conference/program/pdf/14020_paper_etZgfbDr.pdf

Public Debt and Low Interest Rates

By Olivier Blanchard ∗

The lecture focuses on the costs of public debt when safe interest

rates are low. I develop four main arguments.

First, I show that the current U.S. situation in which safe interest

rates are expected to remain below growth rates for a long time,

is more the historical norm than the exception. If the future is

like the past, this implies that debt rollovers, that is the issuance

of debt without a later increase in taxes may well be feasible. Put

bluntly, public debt may have no fiscal cost.

Second, even in the absence of fiscal costs, public debt reduces capital accumulation, and may therefore have welfare costs. I show

that welfare costs may be smaller than typically assumed. The

reason is that the safe rate is the risk-adjusted rate of return on

capital. If it is lower than the growth rate, it indicates that the

risk-adjusted rate of return to capital is in fact low. The average

risky rate however also plays a role. I show how both the average

risky rate and the average safe rate determine welfare outcomes.

Third, I look at the evidence on the average risky rate, i.e. the

average marginal product of capital. While the measured rate of

earnings has been and is still quite high, the evidence from asset

markets suggests that the marginal product of capital may be lower,

with the difference reflecting either mismeasurement of capital or

rents. This matters for debt: The lower the marginal product, the

lower the welfare cost of debt.

Fourth, I discuss a number of arguments against high public debt,

and in particular the existence of multiple equilibria where investors believe debt to be risky and, by requiring a risk premium,

increase the fiscal burden and make debt effectively more risky.

This is a very relevant argument, but it does not have straightforward implications for the appropriate level of debt.

My purpose in the lecture is not to argue for more public debt,

especially in the current political environment. It is to have a

richer discussion of the costs of debt and of fiscal policy than is

currently the case.

∗ Peterson Institute for International Economics and MIT (oblanchard@piie.com) AEA Presidential Lecture, to be given in January 2019. Special thanks to Larry Summers for many discussions and

many insights. Thanks for comments, suggestions, and data to Laurence Ball, Simcha Barkai, Charles

Bean, Philipp Barrett, Ricardo Caballero, John Campbell, John Cochrane, Carlo Cottarelli, Peter Diamond, Stanley Fischer, Francesco Giavazzi, Robert Hall, Patrick Honohan, Anton Korinek, Larry Kotlikoff, Lorenz Kueng, Neil Mehrotra, Jonathan Parker, Thomas Philippon, Jim Poterba, Ricardo Reis,

Dmitriy Sergeyev, Jay Shambaugh, Robert Solow, Jaume Ventura, Philippe Weil, Ivan Werning, Jeromin

Zettelmeyer, and many of my PIIE colleagues. Thanks for outstanding research assistance to Thomas

1

2 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

I. Introduction

Since 1980, interest rates on U.S. government bonds have steadily decreased.

They are now lower than the nominal growth rate, and according to current

forecasts, this is expected to remain the case for the foreseeable future. 10-year

U.S. nominal rates hover around 3%, while forecasts of nominal growth are around

4% (2% real growth, 2% inflation). The inequality holds even more strongly in

the other major advanced economies: The 10-year UK nominal rate is 1.3%,

compared to forecasts of 10-year nominal growth around 3.6% (1.6% real, 2%

inflation). The 10-year Euro nominal rate is 1.2%, compared to forecasts of

10-year nominal growth around 3.2% (1.5% real, 2% inflation).1 The 10-year

Japanese nominal rate is 0.1%, compared to forecasts of 10-year nominal growth

around 1.4% (1.0% real, 0.4% inflation).

The question this paper asks is what the implications of such low rates should

be for government debt policy. It is an important question for at least two reasons.

From a policy viewpoint, whether or not countries should reduce their debt, and

by how much, is a central policy issue. From a theory viewpoint, one of pillars

of macroeconomics is the assumption that people, firms, and governments are

subject to intertemporal budget constraints. If the interest rate paid by the

government is less the growth rate, then the intertemporal budget constraint

facing the government no longer binds. What the government can and should do

in this case is definitely worth exploring.

The paper reaches strong, and, I expect, surprising, conclusions. Put (too)

simply, the signal sent by low rates is that not only debt may not have a substantial

fiscal cost, but also that it may have limited welfare costs.

Given that these conclusions are at odds with the widespread notion that government debt levels are much too high and must urgently be decreased, the paper

considers several counterarguments, ranging from distortions, to the possibility

that the future may be very different from the recent past, to multiple equilibria.

All these arguments have merit, but they imply a different discussion from that

dominating current discussions of fiscal policy.

The lecture is organized as follows.

Section 1 looks at the past behavior of U.S. interest rates and growth rates. It

concludes that the current situation is actually not unusual. While interest rates

on public debt vary a lot, they have on average, and in most decades, been lower

than growth rates. If the future is like the past, the probability that the U.S.

government can do a debt rollover, that is issue debt and achieve a decreasing

debt to GDP ratio without ever having to raise taxes later is high.

That debt rollovers may be feasible does not imply however that they are desirable. Even if higher debt does not give rise later to a higher tax burden, it

Pellet, Colombe Ladreit, and Gonzalo Huertas. Appendices and data sources: https://bit.ly/2xSSw9O

1Different Euro countries have different government bond rates. The 10-year Euro nominal rate

is a composite rate (with changing composition) constructed by the ECB.http://sdw.ecb.europa.eu/

quickview.do?SERIES_KEY=143.FM.M.U2.EUR.4F.BB.U2_10Y.YLD

VOL. VOLUME NO. ISSUE DEBT AND RATES 3

still has effects on capital accumulation, and thus on welfare. Whether and when

higher debt increases or decreases welfare is taken up in Sections 2 and 3.

Section 2 looks at the effects of an intergenerational transfer (a conceptually

simpler policy than a debt rollover, but a policy that shows most clearly the relevant effects at work) in an overlapping generation model with uncertainty. In

the certainty context analyzed by Diamond (1965), whether such an intergenerational transfer from young to old is welfare improving depends on “the” interest

rate, which in that model is simply the net marginal product of capital. If the

interest rate is less than the growth rate, then the transfer is welfare improving.

Put simply, in that case, a larger intergenerational transfer, or equivalently an

increase in public debt, and thus less capital, is good.

When uncertainty is introduced however, the question becomes what interest

rate we should look at to assess welfare effects of such a transfer. Should it be

the average safe rate, i.e. the rate on sovereign bonds (assuming no default risk),

or should it be the average marginal product of capital? The answer turns out to

be: Both.

As in the Diamond model, a transfer has two effects on welfare, an effect through

reduced capital accumulation, and an indirect effect, through the induced change

in the returns to labor and capital.

The welfare effect through lower capital accumulation depends on the safe rate.

It is positive if, on average, the safe rate is less than the growth rate. The intuitive

reason is that, in effect, the safe rate is the relevant risk-adjusted rate of return

on capital, thus it is the rate that must be compared to the growth rate.

The welfare effect through the induced change in returns to labor and capital

depends instead on the (risky) marginal product of capital. It is negative if, on

average, the marginal product of capital exceeds the growth rate.

Thus, in the current situation where it indeed appears that the safe rate is less

than the growth rate, but the average marginal product of capital exceeds the

growth rate, the two effects have opposite signs, and the effect of the transfer on

welfare is ambiguous. The section ends with an approximation which shows most

clearly the relative role of the two rates. The net effect may be positive, if the

safe rate is sufficiently low, and the average marginal product is not too high.

With these results in mind, Section 3 turns to numerical simulations. People

live for two periods, working in the first, and retiring in the second. They have

separate preferences vis-a-vis intertemporal substitution and risk. This allows to

look at different combinations of risky and safe rates, depending on the degree

of uncertainty and the degree of risk aversion. Production is CES in labor and

capital, and subject to technological shocks: Being able to vary the elasticity of

substitution between capital and labor turns out to be important as this elasticity

determines the strength of the second effect on welfare. There is no technological

progress, nor population growth, so the average growth rate is equal to zero.

I show how the welfare effects of a transfer can be positive or negative, and

how they depend in particular on the elasticity of substitution between capital

4 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

and labor. In the case of a linear technology (equivalently, an infinite elasticity

of substitution between labor and capital), the rates of return, while random, are

independent of capital accumulation, so that only the first effect is at work, and

the safe rate is the only relevant rate in determining the effect of the transfer

on welfare. I then show how a lower elasticity of substitution implies a negative

second effect, leading to an ambiguous welfare outcome.

I then turn to debt and show that a debt rollover differs in two ways from

a transfer scheme. First, with respect to feasibility. So long as the safe rate

remains less than the growth rate, the ratio of debt to GDP decreases over time;

a sequence of adverse shocks may however increase the safe rate sufficiently so

as to lead to explosive dynamics, with higher debt increasing the safe rate, and

the higher safe rate in turn increasing debt over time. Second, with respect to

desirability: A successful debt rollover can yield positive welfare effects, but less

so than the transfer scheme. The reason is that a debt rollover pays people a

lower rate of return than the implicit rate in the transfer scheme.

The conclusions, and the welfare effects of debt in Section 3 depend not only

how on low the average safe rate is, but also how high the average marginal

product is. With this in mind, Section 4 returns to the empirical evidence on the

marginal product of capital. It focuses on two facts. The first fact is that the

ratio of the earnings rate of U.S. corporations to their capital at replacement cost

has remained high and relatively stable over time. This suggests a high marginal

product, and thus, other things equal, a higher welfare cost of higher debt. The

second fact, however, is that the ratio of the earnings of U.S. corporations to their

market value has substantially decreased since the early 1980s. Put another way,

Tobin‘s q, which is the ratio of the market value of capital to the value of capital

at replacement cost, has substantially increased. Two potential interpretations

are that capital at replacement cost is poorly measured and does not fully capture

intangible capital. The other is that an increasing proportion of earnings comes

from rents. Both explanations (which are the subject of much current research)

imply a lower marginal product for a given measured earnings rate, and thus a

smaller welfare cost of debt.

Section 5 goes beyond the formal model and places the results in a broader but

informal discussion of the costs and benefits of public debt.

On one side, the model above has looked at debt issuance used to finance

transfers in a full employment economy; this does not do justice to current policy

discussions, which have focused on the role of debt finance to increase demand

and output if the economy is in recession, and on the use of debt to finance public

investment. This research has concluded that, if the neutral rate of interest is low

and the effective lower bound on interest rates is binding, then there is a strong

argument for using fiscal policy to sustain demand. The analysis above suggests

that, in that very situation, the fiscal and welfare costs of higher debt may be

lower than has been assumed, reinforcing the case for a fiscal expansion.

On the other side, (at least) three arguments can be raised against the model

VOL. VOLUME NO. ISSUE DEBT AND RATES 5

above and its implications. The first is that the risk premium, and by implication

the low safe rate relative to the marginal product of capital, may not reflect

risk preferences but distortions, such as financial repression. Traditional financial

repression, i.e. forcing banks to hold government bonds, is gone in the United

States, but one may argue that agency issues within financial institutions or

some forms of financial regulation such as liquidity ratios have similar effects.

The second argument is that the future may be very different from the present,

and the safe rate may turn out much higher than the past. The third argument is

the possibility of multiple equilibria, that if investors expect the government to be

unable to fully repay the debt, they may require a risk premium which makes debt

harder to pay back and makes their expectations self-fulfilling. I focus mostly on

this third argument. It is relevant and correct as far as it goes, but it is not clear

what it implies for the level of public debt: Multiple equilibria typically hold for

a large range of debt, and a realistic reduction in debt while debt remains in the

range, does not rule out the bad equilibrium.

Section 6 concludes. To be clear: The purpose of the lecture is not to advocate

for higher public debt, but to assess its costs. The hope is that this lecture leads

to a richer discussion of fiscal policy than is currently the case.

II. Interest rates, growth rates, and debt rollovers

Interest rates on U.S. bonds have been and are still unusually low, reflecting in

part the after-effects of the Great Financial Crisis and Quantitative Easing. The

current (December 2018) 1-year T-bill nominal rate is 2.6%, substantially below

the most recent nominal growth rate, 4.8% (from the second to the third quarter,

at annual rates)

The gap between the two is expected to narrow, but most forecasts and market signals have interest rates remaining below growth rates for a long time to

come. Despite a strong fiscal expansion putting pressure on rates in an economy

close to potential, the current 10-year nominal rate remains around 3%, while

forecasts of nominal growth over the same period are around 4%. Looking at real

rates instead, the current 10-year inflation-indexed rate is around 1%, while most

forecasts of real growth over the same period range from 1.5% to 2.5%.2

These forecasts come with substantial uncertainty. Some argue that these low

rates reflect “secular stagnation” forces that are likely to remain relevant for

the foreseeable future3

. Others point instead to factors such as aging in advanced

economies, better social insurance or lower reserve accumulation in emerging markets, which may lead to higher rates in the future (See for example Lukasz and

2Since 1800, 10-year rolling sample averages of U.S. real growth have always been positive, except for

one 10-year period, centered in 1930.

3Some point to structurally high saving and low investment, leading to a low equilibrium marginal

product of capital (for example, Summers (2015), Rachel and Summers (2018). Others point instead

to an increased demand for safe assets, leading to a lower safe rate for a given marginal product (for

example, Caballero, Farhi, and Gourinchas (2017). An interesting attempt to identify the respective

roles of marginal products, rents, and risk premia is given by Caballero, Farhi and Gourinchas (2017b)

6 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

Smith 2015, Lunsford and West (2018)).

Interestingly and importantly however, historically for the United States government, interest rates lower than growth rates have been more the rule than the

exception, making the issue of what debt policy should be under this configuration

of more than temporary interest.4

.

Evidence on past interest rates and growth rates has been put together by,

among others, Shiller (1992) and Jorda et al (2017).5 While the basic conclusions

reached below hold over longer periods, I shall limit myself here to the post-1950

period.6 Figure (1) shows the evolution of the nominal GDP growth rate and the

1-year Treasury bill rate. Figure (2) shows the evolution of nominal GDP growth

rate and the 10-year Treasury bond rate. Together, they have two basic features:

Figure 1. : Nominal growth rate and 1-year T-bill rate

‐4

‐2

0

2

4

6

8

10

12

14

16

Nominal growth rate and 1‐year T‐bill rate

1‐year T‐bill rate nominal growth rate

• On average, over the period, nominal interest rates have been lower than

nominal growth rates.7 The 1-year rate has averaged 4.7%, the 10-year rate

has averaged 5.6%, while nominal GDP growth has averaged 6.3%.8

4Two other papers have examined the historical relation between interest rates and growth rates, both

in the United States and abroad, and draw some of the implications for debt dynamics: Mehrotra(2017),

and Barrett (2018).

5For evidence going back to the 14th century, see Schmelzing (2018).

6There is a striking difference not so much in the level but in the stochastic behavior of rates preand post-1950, with a sharp decrease in volatility post-1950.

7Equivalently, if one uses the same deflator, real interest rates have been lower than real growth rates.

Real interest rates are however often computed using CPI inflation rather than the GDP deflator.

8Using Shiller’s numbers for interest rates and historical BEA series for GDP, over the longer period

VOL. VOLUME NO. ISSUE DEBT AND RATES 7

Figure 2. : Nominal growth rate and 10-year bond rate

‐4

‐2

0

2

4

6

8

10

12

14

16 Nominal growth rate and 10‐year bond rate

nominal 10‐year rate nominal growth rate

• Both the 1-year rate and the 10-year rate were consistently below the growth

rate until the disinflation of the early 1980s, Since then, both nominal interest rates and nominal growth rates have declined, with rates declining

faster than growth, even before the Great Financial Crisis. Overall, while

nominal rates vary substantially from year to year, the 1-year rate has been

lower than the growth rate for all decades except for the 1980s. The 10-year

rate has been lower than the growth rate for 4 out of 7 decades.

Given that my focus is on the implications of the joint evolution of interest

rates and growth rates for debt dynamics, the next step is to construct a series

for the relevant interest rate paid on public debt held by domestic private and

foreign investors. I proceed in three steps, first taking into account the maturity

composition of the debt, second taking into account the tax payments on the

interest received by the holders of public debt, and third, taking into account

Jensen’s inequality. (Details of construction are given in appendix A.)9

To take into account maturity, I use information on the average maturity of the

debt held by private investors (that is excluding public institutions and the Fed.)

This average maturity went down from 8 years and 4 months in 1950 to 3 years

and 4 months in 1974, with a mild increase since then to 5 years today.10 Given

1871 to 2018, the 1-year rate has averaged 4.6%, the 10-year rate 4.6% and nominal GDP growth 5.3%.

9A more detailed construction of the maturity of the debt held by both private domestic and foreign

investors is given in Hilscher et al (2018).

10Fed holdings used to be small, and limited to short maturity T-bills. As a result of quantitative

8 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

this series, I construct a maturity-weighted interest rate as a weighted average

of the 1-year and the 10-year rates using it = αt ∗ i1,t + (1 − αt) ∗ i10,t with

αt = (10 − average maturity in years)/9.

Many, but not all, holders of government bonds pay taxes on the interest paid,

so the interest cost of debt is actually lower than the interest rate itself. There is

no direct measure of those taxes, and thus I proceed as follows:1112

I measure the tax rate of the marginal holder by looking at the difference

between the yield on AAA municipal bonds (which are exempt from Federal taxes)

and the yield on a corresponding maturity Treasury bond, for both 1-year and 10-

year bonds. Assuming that the marginal investor is indifferent between holding

the two, the implicit tax rate on 1-year treasuries is given by τ1t = 1 − imt1/i1t

,

and the implicit tax rate on 10-year Treasuries is given by τ10t = 1 − imt10/i10t

.

13

The tax rate on 1-year bonds peaks at about 50% in the late 1970s (as inflation

and nominal rates are high, leading to high effective tax rates), then goes down

close to zero until the Great Financial Crisis, and has increased slightly since

2017. The tax rate on 10-year bonds follows a similar pattern, down from about

40% in the early 1980s to close to zero until the Great Financial Crisis, with a

small increase since 2016. 14 Taking into account the maturity structure of the

debt, I then construct an average tax rate in the same way as I constructed the

interest rate above, by constructing τt = αt ∗ τ1,t + (1 − αt) ∗ τ10,t

Not all holders of Treasuries pay taxes however. Foreign holders, private and

public (such as central banks), Federal retirement programs and Fed holdings are

not subject to tax. The proportion of such holders has steadily increased over

time, reflecting the increase in emerging markets’ reserves (in particular China’s),

the growth of the Social Security Trust Fund, and more recently, the increased

holdings of the Fed, among other factors. From 15% in 1950, it now accounts for

64% today.

Using the maturity adjusted interest rate from above, it

, the implicit tax rate,

τt

, and the proportion of holders likely subject to tax, βt

, I construct an “adjusted

interest rate” series according to:

iadj,t = it(1 − τt ∗ βt)

Its characteristics are shown in Figures (3) and (4). Figure (3) plots the adjusted

easing, they have become larger and skewed towards long maturity bonds, implying a lower maturity of

debt held by private investors than of total debt.

11For a parallel study, see Feenberg et al (2018).

12This is clearly only a partial equilibrium computation. To the extent that debt leads to lower

capital accumulation and thus lower output, other tax revenues may decrease. To the extent however

that consumption decreases less, or even increases, the effects depend on how much of taxation is output

based or consumption based.

13This is an approximation. On the one hand, the average tax rate is likely to exceed this marginal

rate. On the other hand, to the extent that municipal bonds are also partially exempt from state taxes,

the marginal tax rate may reflect in part the state tax rate in addition to the Federal tax rate.

14The computed tax rates are actually negative during some of the years of the Great Financial Crisis,

presumably reflecting the effects of Quantitative Easing. I put them equal to zero for those years

VOL. VOLUME NO. ISSUE DEBT AND RATES 9

rate against the 1-year and the 10-year rates. Figure (4) plots the adjusted tax

rate against the nominal growth rate. They yield two conclusions:

Figure 3. : 1-year rate, 10-year rate, and adjusted rate

0

2

4

6

8

10

12

14

16

1‐year rate, 10‐year rate, adjusted rate

10‐year rate 1‐year rate adjusted rate

Figure 4. : Nominal growth rate and adjusted rate

‐4

‐2

0

2

4

6

8

10

12

14

16

Nominal GDP growth and adjusted interest rate

Adjusted rate Nominal GDP growth

• First, over the period, the average adjusted rate has been lower than either

the 1-year or the 10-year rates, averaging 3.8% since 1950. This however

largely reflects the non neutrality of taxation to inflation in the 1970s and

10 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

1980s, and which is much less of a factor today. Today, the rate is around

2.4%.

• Second, over the period, the average adjusted rate has been substantially

lower than the average nominal growth rate, 3.8% versus 6.3%.

The third potential issue is Jensen’s inequality. The dynamics of the ratio of

debt to GDP are given by:

dt =

1 + radj,t

1 + gt

dt−1 + xt

where dt

is the ratio of debt to GDP (with both variables either in nominal or

in real terms if both are deflated by the same deflator), and xt

is the ratio of the

primary deficit to GDP (again, with both variables either in nominal or in real

terms). The evolution of the ratio depends on the relevant product of interest

rates and growth rates (nominal or real) over time.

Given the focus on debt rollovers, that is the issuance of debt without a later

increase in taxes or reduction in spending, suppose we want to trace debt dynamics

under the assumption that xt remains equal to zero.15 Suppose that ln[(1 +

radj,t)/(1 + gt)] is distributed normally with mean µ and variance σ

2

. Then, the

evolution of the ratio will depend not on exp µ but on exp(µ + (1/2)σ

2

). We

have seen that, historically, µ was between -1% and -2%. The standard deviation

of the log ratio over the same sample was equal to 2.8%, implying a variance of

0.08%, thus too small to affect the conclusions substantially. Jensen’s inequality

is thus not an issue here.16

In short, if we assume that the future will be like the past (a big if admittedly),

debt rollovers—that is increases in debt without a change in the primary surplus—

appear feasible. While the debt ratio may increase for some time due to adverse

shocks to growth or positive shocks to the interest rate, it will eventually decrease

over time. In other words, higher debt may not imply a higher fiscal cost.

In this light, it is interesting to do the following counterfactual exercise. Assume

that the debt ratio in year t was what it actually was, but that the primary balance

was equal to zero from then on, so that debt in year t + n was given by:

dt+n = (

i

Y=n

i=1

1 + radj,t+i

1 + gt+i

) dt

15Given that we subtract taxes on interest from interest payments, the primary balance must also be

computed subtracting those tax payments.

16The conclusion is the same if we do not assume log normality, but rather bootstrap from the actual

distribution, which has slightly fatter tails.

VOL. VOLUME NO. ISSUE DEBT AND RATES 11

Figure 5. : Debt dynamics, with zero primary balance, starting in year t.

40 60 80 100 120 140

index

1950 1960 1970 1980 1990 2000 2010 2020

year

Figure 6. : Debt dynamics, with zero primary balance, starting in year t, using

adjusted rate

20 40 60 80 100

index

1950 1960 1970 1980 1990 2000 2010 2020

year

Figures (5) and (6) show what the evolution of the debt ratio would have been,

starting at different dates in the past. For convenience, the ratio is normalized to

100 at each starting date, so 100 in 1950, 100 in 1960, and so on. Figure (5) uses

the non-tax adjusted rate, Figure (6) uses the tax-adjusted interest rate.

Figure (5) shows how, for each starting date, the debt ratio would eventually

have decreased, even in the absence of a primary surplus. The decrease, if starting

in the 1950s, 1960s, or 1970s, is quite dramatic. But it also shows that a series of

bad shocks, such as happened in the 1980s, can increase the debt ratio to higher

12 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

levels for a while.

Figure (6), which I believe is the more appropriate one, gives an even more

optimistic picture, where the debt ratio rarely would have increased, even in the

1980s—the reason being the higher tax revenues associated with inflation during

that period.

What these figures show is that, historically, debt rollovers would have been

feasible. Put another way, it shows that the fiscal cost of higher debt would have

been small, if not zero. This is at striking variance with the current discussions

of fiscal space, which all start from the premise that the interest rate is higher

than the growth rate, implying a tax burden of the debt.

The fact that debt rollovers may be feasible (i.e. that they have not fiscal cost)

does not imply however that they are desirable (that they have no welfare cost).

This is the topic taken up in the next two sections.

III. Intergenerational transfers and welfare

Debt rollovers are, by essence, non-steady-state phenomena, and have potentially complex dynamics and welfare effects. It is useful to start by looking at a

simpler policy, namely a transfer from the young to the old (equivalent to pay-asyou-go social security), and then to return to debt and debt rollovers in the next

section.

The natural set-up to explore the issues is an overlapping generation model

under uncertainty. The overlapping generation structure implies a real effect

of intergenerational transfers or debt, and the presence of uncertainty allows to

distinguish between the safe rate and the risky marginal product of capital.17

I proceed in two steps, first briefly reviewing the effects of a transfer under certainty, following Diamond (1965), then extending it to uncertainty. (Derivations

are given in Appendix B)18

Assume that the economy is populated by people who live for two periods,

working in the first period, and consuming in both periods. Their utility is given

by:

U = (1 − β)U(C1) + βU(C2)

where C1 and C2 are consumption in the first and the second period respectively.

17In this framework, the main effect of intergenerational transfers or debt is to decrease capital accumulation. A number of recent papers have explored the effects of public debt when public debt also

provides liquidity services. Aiyagari and McGrattan (1998) for example explore the effects of public

debt in an economy in which agents cannot borrow and thus engage in precautionary saving; in that

framework, debt relaxes the borrowing constraint and decreases capital accumulation. Angeletos, Collard

and Dellas (2016) develop a model where debt provides liquidity. In that model, debt can either crowd

out capital, for the same reasons as in Aiyagari and McGrattan, or crowd in capital by increasing the

available collateral required for investment. These models are obviously very different from the model

presented here, but all share a focus on the low riskless rate as a signal about the desirability of public

debt.

18For a nice recent introduction to the logic and implications of the overlapping generation model, see

Weil (2008).

VOL. VOLUME NO. ISSUE DEBT AND RATES 13

(As I limit myself for the moment to looking at the effects of the transfer on utility

in steady state, there is no need for now for a time index.) Their first and second

period budget constraints are given by

C1 = W − K − D ; C2 = R K + D

where W is the wage, K is saving (equivalently, next period capital), D is the

transfer from young to old, and R is the rate of return on capital.

I ignore population growth and technological progress, so the growth rate is

equal to zero. Production is given by a constant returns production function:

Y = F(K, N)

It is convenient to normalize labor to 1, so Y = F(K, 1). Both factors are paid

their marginal product.

The first order condition for utility maximisation is given by:

(1 − β) U

0

(C1) = βR U0

(C2)

The effect of a small increase in the transfer D on utility is given by:

dU = [−(1 − β)U

0

(C1) + βU0

(C2)] dD + [(1 − β)U

0

(C1) dW + βKU0

(C2) dR]

The first term in brackets, call it dUa, represents the partial equilibrium, direct, effect of the transfer; the second term, call it dUb, represents the general

equilibrium effect of the transfer through the induced change in wages and rates

of return.

Consider the first term, the effect of debt on utility given labor and capital

prices. Using the first-order condition gives:

(1) dUa = [β(−R U0

(C2) + U

0

(C2))] dD = β(1 − R)U

0

(C2) dD

So, if R < 1 (the case known as “dynamic inefficiency”), then, ignoring the

other term, a small increase in the transfer increases welfare. The explanation is

straightforward: If R < 1, the transfer gives a higher rate of return to savers than

does capital.

Take the second term, the effect of debt on utility through the changes in W

and R. An increase in debt decreases capital and thus decreases the wage and

increases the rate of return on capital. What is the effect on welfare?

Using the factor price frontier relation dW/dR = −K/N,or equivalently dW =

14 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

−KdR (given that N = 1), rewrite this second term as:

dUb = −[(1 − β)U

0

(C1) − βU0

(C2)]K dR

Using the first order condition for utility maximization gives:

dUb = −[β(R − 1)U

0

(C2)]K dR

So, if R < 1 then, just like the first term, a small increase in the transfer

increases welfare (as the lower capital stock leads to an increase in the interest

rate). The explanation is again straightforward: Given the factor price frontier

relation, the decrease in the capital leads to an equal decrease in income in the

first period and increase in income in the second period. If R < 1, this is more

attractive than what capital provides, and thus increases welfare.

Using the definition of the elasticity of substitution η ≡ (FKFN )/FKN F, the

definition of the share of labor, α = FN /F, and the relation between second

derivatives of the production function, FNK = −KFKK, this second term can be

rewritten as:

(2) dUb = [β(1/η)α][(R − 1)U

0

(C2)]R dK

Note the following two implications of equations (1) and (2):

• The sign of the two effects depends on R−1. If R < 1, the a decrease in capital accumulation increases utility. In other words, if the marginal product is

less than the growth rate (which here is equal to zero), an intergenerational

transfer has a positive effect on welfare in steady state.

• The strength of the second effect depends on the elasticity of substitution

η. If for example η = ∞ so the production function is linear and capital

accumulation has no effect on either wages or rates of return to capital, this

second effect is equal to zero.

So far, I just replicated the analysis in Diamond.19 Now introduce uncertainty

in production, so the marginal product of capital is uncertain. If people are risk

averse, the average safe rate will be less than the average marginal product of

capital. The basic question becomes:

What is the relevant rate we should look at for welfare purposes? Put loosely,

is it the average marginal product of capital ER, or is it the average safe rate

ERf, or it is some other rate altogether?

The model is the same as before, except for the introduction of uncertainty:

19Formally, Diamond looks at the effects of a change in debt rather than a transfer. But, under

certainty and in steady state, the two are equivalent.

VOL. VOLUME NO. ISSUE DEBT AND RATES 15

People born at time t have expected utility given by: (I now need time subscripts

as the steady state is stochastic):

U = (1 − β)U(C1,t) + βEU(C2,t+1)

Their budget constraints are given by

C1t = Wt − Kt − D ; C2t+1 = Rt+1 Kt + D

Production is given by a constant returns production function

Yt = AtF(Kt−1, N)

where N = 1 and At

is stochastic. (The capital at time t reflects the saving of

the young at time t − 1, thus the timing convention).

At time t, the first order condition for utility maximization is given by:

(1 − β) U

0

(C1,t) = βE[Rt+1 U

0

(C2,t+1)]

We can now define a shadow safe rate R

f

t+1, which must satisfy:

R

f

t+1E[U

0

(C2,t+1] = E[Rt+1 U

0

(C2,t+1)]

Now consider a small increase in D on utility at time t:

dUt = [−(1−β)U

0

(C1,t)+βEU0

(C2,t+1)] dD+[(1−β)U

0

(C1,t) dWt+βKtE(U

0

(C2,t+1) dRt+1)]

As before, the first term in brackets, call it dUat, reflects the partial equilibrium,

direct, effect of the transfer, the second term, call it dUbt, reflects the general

equilibrium effect of the transfer through the change in wages and rates of return

to capital.

Take the first term, the effect of debt on utility given prices. Using the first

order condition gives:

dUat = [−βE[Rt+1 U

0

(C2,t+1)] + βE[U

0

(C2,t+1)]] dD

So:

(3) dUat = β(1 − R

f

t+1)EU0

(C2,t+1) dD

So, to determine the sign effect of the transfer on welfare through this first

channel, the relevant rate is indeed the safe rate. In any period in which R

f

t+1

16 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

is less than one, the transfer is welfare improving.

The explanation why the safe rate is what matters is straightforward and important: The safe rate is, in effect, the risk-adjusted rate of return on capital.20

The intergenerational transfer gives a higher rate of return to people than the

risk-adjusted rate of return on capital.

Take the second term, the effect of the transfer on utility through prices:

dUbt = (1 − β)U

0

(C1,t) dWt + βE[U

0

(C2,t+1) Kt dRt+1]

Or using the factor price frontier relation:

dUbt = (1 − β)U

0

(C1,t) Kt−1dRt + βE[U

0

(C2,t+1) Kt dRt+1]

In general, this term will depend both on dKt−1 (which affects dWt) and on dKt

(which affects dRt+1). If we evaluate it at Kt = Kt−1 = K and dKt = dKt+1 =

dK, it can be rewritten, using the same steps as in the certainty case, as:

(4) dUbt = [β

1

η

α] E[(Rt+1 −

Rt+1

Rt

)U

0

(C2,t+1)]RtdK

Or:

(5) dUbt = [β

1

η

α

1

Rt

] E[(Rt+1U

0

(C2,t+1)](Rt − 1)dK

Thus the relevant rate in assessing the sign of the welfare effect of the transfer

through this second term is the risky rate, the marginal product of capital.

If Rt

is less than one, the implicit transfer due to the change in input prices

increases utility. If Rt

is greater than one, the implicit transfer decreases utility.

The explanation why it is the risky rate that matters is simple. Capital yields

a rate of return of Rt+1. The change in prices due to the decrease in capital

represents an implicit transfer with rate of return of Rt+1/Rt

. Thus, whether the

implicit transfer increases or decreases utility depends on whether Rt

is less or

greater than one.

Putting the two sets of results together: If the safe rate is less than one, and

the risky rate is greater than one—the configuration which appears to be relevant

today—the two terms now work in opposite directions: The first term implies that

an increase in debt increases welfare. The second term implies that an increase

in debt instead decreases welfare. Both rates are thus relevant.

20The relevance of the safe rate in assessing the return to capital accumulation was one of themes in

Summers (1990).

VOL. VOLUME NO. ISSUE DEBT AND RATES 17

To get a sense of relative magnitudes of the two effects, and therefore which

one is likely to dominate, the following approximation is useful: Evaluate the two

terms at the average values of the safe and the risky rates, to get:

dU/dD = [(1 − ERf

) − (1/η) α ERf

(ER − 1)] βE[U

0

(C2)](−dK/dD)

so that:

(6) sign dU ≡ sign [(1 − ERf

) − (1/η)αERf

(−dK/dD)(ER − 1)]

where, from the accumulation equation, we have the following approximation:21

dK/dD ≈ −

1

1 − βα(1/η)ER

Note that, if the production is linear, and so η = ∞, the second term in equation

(6) is equal to zero, and the only rate that matters is ERf

. Thus, if ERf

is less

than one, a higher transfer increases welfare. As the elasticity of substitution

becomes smaller, the price effect becomes stronger, and, eventually, the welfare

effect changes sign and becomes negative.

In the Cobb-Douglas case, using the fact that ER ≈ (1 − α)/(αβ), (the approximation comes from ignoring Jensen’s inequality) the equation reduces to the

simpler formula:

(7) sign dU ≡ sign [(1 − ERf ER)]

Suppose that the average annual safe rate is 2% lower than the growth rate, so

that ERf

, the gross rate of return over a unit period—say 25 years—is 0.9825 =

0.6, then the welfare effect of a small increase in the transfer is positive if ER is

less than 1.66, or equivalently, if the average annual marginal product is less than

2% above the growth rate.22

Short of a much richer model, it is difficult to know how reliable these rough

computations are as a guide to reality. The model surely overstates the degree of

21This is an approximation in two ways. It ignores uncertainty and assumes that the direct effect of

the transfer on saving is 1 for 1, which is an approximation.

22Note that the economy we are looking at may be dynamically efficient in the sense of Zilcha (1991).

Zilcha defined dynamic efficiency as the condition that there is no reallocation such that consumption

of either the young or the old can be increased in at least one state of nature and one period, and not

decreased in any other; the motivation for the definition is that it makes the condition independent

of preferences. He then showed that in a stationary economy, a necessary and sufficient condition for

dynamic inefficiency is that E ln R > 0. What the argument in the text has shown is that an intergenerational transfer can be welfare improving even if the Zilcha condition holds: As we saw, expected utility

can increase even if the average risky rate is large, so long as the safe rate is low enough. The reallocation

is such that consumption indeed decreases in some states, yet expected utility is increased.

18 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

non Ricardian equivalence: Debt in this economy is (nearly fully) net wealth, even

if Rf

is greater than one, and the government must levy taxes to pay the interest

to keep the debt constant. The assumption that capital and labor are equally

risky may not be right: Holding claims to capital, i.e. shares, involves price risk,

which is absent from the model, as capital fully depreciates within a period; on

the other hand, labor income, in the absence of insurance against unemployment,

can also be very risky. Another restrictive assumption of the model is that the

economy is closed: In an open economy, the effect on capital is likely to be smaller,

with changes in public debt being partly reflected in increases in external debt.

I return to the issue when discussing debt (rather than intertemporal transfers)

later. Be this as it may, the analysis suggests that the welfare effects of a transfer

may not necessarily be adverse, or, if adverse, may not be very large.

IV. Simulations. Transfers, debt, and debt rollovers

To get a more concrete picture, and turn to the effects of debt and debt rollovers

requires going to simulations.23 Within the structure of the model above, I make

the following specific assumptions: (Derivations and details of simulation are

given in Appendix C.)

I think of each of the two periods of life as equal to twenty five years. Given the

role of risk aversion in determining the gap between the average safe and risky

rates, I want to separate the elasticity of substitution across the two periods of

life and the degree of risk aversion. Thus I assume that utility has an EpsteinZin-Weil representation of the form (Epstein and Zin(2013), Weil (1990)):

(1 − β) ln C1,t + β

1

1 − γ

ln E(C

1−γ

2,t+1)

The log-log specification implies that the intertemporal elasticity of substitution

is equal to 1. The coefficient of relative risk aversion is given by γ.

As the strength of the second effect above depends on the elasticity of substitution between capital and labor, I assume that production is characterized

by a constant elasticity of substitution production function, with multiplicative

uncertainty:

Yt = At (bKρ

t−1 + (1 − b)N

ρ

)

1/ρ = At(bKρ

t−1 + (1 − b))1/ρ

where At

is white noise and is distributed log normally, with ln At ∼ N (µ; σ

2

)

and ρ = (η − 1)/η, where η is the elasticity of substitution. When η = ∞, ρ = 1

and the production function is linear.

Finally, I assume that, in addition to the wage, the young receive a nonstochastic endowment, X. Given that the wage follows a log normal distribution

23One can make some progress analytically, and, in Blanchard and Weil (1990), we did characterize

the behavior of debt at the margin (that is, taking the no-debt prices as given), for a number of different

utility and production functions and different incomplete market structures. We only focused on debt

dynamics however, and not on the normative implications.

VOL. VOLUME NO. ISSUE DEBT AND RATES 19

and thus can be arbitrarily small, such an endowment is needed to make sure that

the deterministic transfer from the young to the old is always feasible, no matter

what the realization of W.

24 I assume that the endowment is equal to 100% of

the average wage.

Given the results in the previous section, I calibrate the model so as to fit

a set of values for the average safe rate and the average risky rate. I consider

average net annual risky rates (marginal products of capital) minus the growth

rate (here equal to zero) between 0% and 4%. These imply values of the average

25-year gross risky rate, ER, between 1.00 and 2.66. I consider average net annual

safe rates minus the growth rate between -2% and 1%; these imply values of the

average 25-year gross safe rate, ERf

, between 0.60 and 1.28.

I choose some of the coefficients a priori. I choose b (which is equal to the

capital share in the Cobb-Douglas case) to be 1/3. For reasons explained below,

I choose the annual value of σa to be a high 4% a year, which implies a value of

σ of √

25 ∗ 4% = 0.20.

Because the strength of the second effect above depends on the elasticity of

substitution, I consider two different values of η, η = ∞ which corresponds to

the linear production function case, and in which the price effects of lower capital

accumulation are equal to zero, and η = 1, the Cobb-Douglas case, which is

generally seen as a good description of the production function in the medium

run.

The central parameters are, on the one hand, β and µ, and on the other, γ.

The parameters β and µ determine (together with σ, which plays a minor role)

the average level of capital accumulation and thus the average marginal product

of capital—the average risky rate. In general, both parameters matter. In the

linear production case however, the marginal product of capital is independent of

the level of capital, and thus depends only on µ; thus, I choose µ to fit the average

value of the marginal product. In the Cobb-Douglas case, the marginal product

of capital is instead independent of µ and depends only on β; thus I choose β to

fit the average value of the marginal product of capital.

The parameter γ determines, together with σ the spread between the risky rate

and the safe rate. In the absence of transfers, the following relation holds between

the two rates:

ln R

f

t+1 − ln ERt+1 = −γσ2

This relation implies however that the model suffers from a strong case of the

equity premium puzzle (see for example Kocherlakota (1996)). If we think of σ

as the standard deviation of TFP growth, and assume that, in the data, TFP

growth is a random walk (with drift), this implies an annual value of σa of about

24Alternatively, a lower bound on the wage distribution will work as well. But this would imply

choosing another distribution than the log normal assumption.

20 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

2%, equivalently a value of σ over the 25-year period of 10%, and thus a value of

σ

2 of 1%. Thus, if we think of the annual risk premium as, say, 5%, which implies

a value of the right hand side of 1.22, this implies a value of γ, the coefficient

of relative risk aversion of 122, which is clearly implausible. One of the reasons

why the model fails so badly is the symmetry in the degree of uncertainty facing

labor and capital, and the absence of price risk associated with holding shares

(as capital fully depreciates within the 25-year period). If we take instead σ to

reflect the standard deviation of annual rates of stock returns, say 15% a year (its

historical mean), and assume stock returns to be uncorrelated over time, then σ

over the 25-year period is equal to 75%, implying values of γ around 2.5. There

is no satisfactory way to deal with the issue within the model, so as an uneasy

compromise, I choose σ = 20%. Given σ, γ is determined for each pair of average

risky and safe rates.25

I then consider the effects on steady state welfare of an intergenerational transfer. The basic results are summarized in the four figures below.

Figure (7) shows the welfare effects of a small transfer (5% of the endowment)

on welfare for the different combinations of the safe and the risky rates (reported,

for convenience, as net rates at annual values, rather than as gross rates at 25-year

values), in the case where η = ∞ and, thus, production is linear. In this case, the

derivation above showed that, to a first order, only the safe rate mattered. This

is confirmed visually in the figure. Welfare increases if the safe rate is negative

(more precisely, if it is below the growth rate, here equal to zero), no matter what

the average risky rate.

Figure (8) looks at a larger transfer (20% of the endowment), again in the

linear production case. For a given ERf

, a larger ER leads to a smaller welfare

increase if welfare increases, and to a larger welfare decrease if welfare decreases.

The reason is as follows: As the size of the transfer increases, second period

income becomes less risky, so the risk premium decreases, increasing ERf

for

given average ER. In the limit, a transfer which led people to save nothing in

capital would eliminate uncertainty about second period income, and thus would

lead to ERf = ER. The larger ER, the faster ERf

increases with a large transfer;

for ER high enough , and for D large enough, ERf becomes larger than one, and

the transfer becomes welfare decreasing.

In other words, even if the transfer has no effect on the average rate of return

to capital, it reduces the risk premium, and thus increases the safe rate. At some

point, the safe rate becomes positive, and the transfer has a negative effect on

welfare.

Figures (9) and (10) do the same, but now for the Cobb-Douglas case. They

25Extending the model to allow uncertainty to differ for capital and labor is difficult to do (except for

the case where production is linear and one can easily capture capital or labor augmenting technology

shocks. In this case, the qualitative discussion of the previous section remains relevant.)

VOL. VOLUME NO. ISSUE DEBT AND RATES 21

Figure 7. : Welfare effects of a transfer of 5% of the endowment(linear production

function)

-1

-0.5

0

0.5

1

1.5

2

4 3.5 3 2.5 2 1.5 1 -2 0.5 -1 -1.5

0 -0.5 0 1 0.5

Figure 8. : Welfare effects of a transfer of 20% of the endowment (linear production

function)

-3

-2

-1

0

1

2

3

4

4

5

3.5

3

2.5

2

1.5 -2 -1.5 1 -1 0.5 -0.5 0 0 0.5 1

22 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

yield the following conclusions: Both effects are now at work, and both rates

matter: A lower safe rate makes it more likely that the transfer will increase

welfare; a higher risky rate makes it less likely. For a small transfer (5% of the

endowment), a safe rate 1% lower than the growth rate leads to an increase in

welfare so long the risky rate is less than 1.7% above the growth rate. A safe rate

2% lower than the growth rate leads to an increase in welfare so long the risky

rate is less than 3.3% above the growth rate. For a larger transfer, (10% of the

endowment), which increases the average Rf

closer to 1, the trade-off becomes

less attractive. For welfare to increase, a safe rate of 2% less than the growth rate

requires that the risky rate be less than 2.3% above the growth rate; a safe rate

of 1% below the growth rate requires that the risky rate be less than 1.5% above

the growth rate.

Figure 9. : Welfare effects of a transfer of 5% of the endowment. Cobb-Douglas

I have so far focused on intergenerational transfers, such as we might observe

in a pay-as-you-go system. Building on this analysis, I now turn to debt, and

proceed in two steps, first looking at the effects of a permanent increase in debt,

then at debt rollovers.

Suppose the government increases the level of debt and maintains it at this

higher level forever. Depending on the value of the safe rate every period, this

may require either issuing new debt when R

f

t < 1 and distributing the proceeds as

VOL. VOLUME NO. ISSUE DEBT AND RATES 23

Figure 10. : Welfare effets of a transfer of 10% of the endowment. Cobb Douglas

benefits, or retiring debt, when R

f

t > 1 and financing it through taxes. Following

Diamond, assume that benefits and taxes are paid to, or levied on, the young. In

this case, the budget constraints faced by somebody born at time t are given by:

C1t = (Wt + X + (1 − R

f

t

)D) − (Kt + D) = Wt + X − Kt − DRf

t

C2t+1 = Rt+1Kt + DRf

t+1

So, a constant level of debt can be thought of as an intergenerational transfer,

with a small difference relative to the case developed earlier. The difference is

that a generation born at t makes a net transfer of DRf

t when young, and receives,

when old, a net transfer of DRf

t+1, as opposed to the one-for-one transfer studied

earlier. Under certainty, in steady state, Rf

is constant and the two are equal.

Under uncertainty, the variation about the terms of the intertemporal transfer

imply a smaller increase in welfare than in the transfer case. Otherwise, the

conclusions are very similar.

This is a good place to discuss informally a possible extension of the closed

economy model, and allow the economy to be open. Start by thinking of a small

open economy which takes Rf as given and unaffected by its actions. In this case,

if Rf

is less than one, an increase in debt unambiguously increases welfare. The

reason is that capital accumulation is unaffected, with the increase in debt fully

24 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

reflected in an increase in external debt, so the second effect characterized above

is absent. In the case of a large economy such as the United States, an increase

in debt will lead to both an increase in external debt and a decrease in capital

accumulation. While the decrease in capital accumulation is the same as above

for the world as a whole, the decrease in U.S. capital accumulation is smaller than

in the closed economy. Thus, the second effect is smaller; if it were adverse, it

is less adverse. This may not be the end of the story however: Other countries

suffer from the decrease in capital accumulation, leading possibly to a change in

their own debt policy. I leave this extension to another paper.

Let me finally turn to the effects of a debt rollover, where the government, after

having issued debt and distributed the proceeds as transfers, does not raise taxes

thereafter, and lets debt dynamics play out.

The government issues debt D0. Unless the debt rollover fails, there are neither

taxes nor subsidies after the initial issuance and associated transfer. The budget

constraints faced by somebody born at time t are thus given by:

C1t = Wt + X − (Kt + Dt)

C2t+1 = Rt+1Kt + DtR

f

t+1

And debt follows:

Dt = R

f

t Dt−1

First, consider sustainability. Even if debt decreases in expected value over

time, a debt rollover, i.e. the issuance of debt paying R

f

t

, may fail with positive

probability. A sequence of realizations of R

f

t > 1 may increase debt to the level

where Rf becomes larger than one and remains so, leading to a debt explosion.

At some point, an adjustment will have to take place, either through default, or

through an increase in taxes. The probability of such a sequence over a long but

finite period of time is however likely to be small if Rf

starts far below 1.26

This is shown in Figure (11), which plots 1000 stochastic paths of debt evolutions, under the assumption that the production function is linear, and Figure

(12), under the assumption that the production function is Cobb-Douglas. In

both cases, the initial increase in debt is equal to 16.875%) of the endowment.27

26In my paper with Philippe Weil (Blanchard Weil 2001), we characterized debt dynamics, based on

an epsilon increase in debt, under different assumptions about technology and preferences. We showed

in particular that, under the assumptions in the text, debt would follow a random walk with negative

drift. We did not however look at welfare implications.

27These may seem small relative to actual debt to income ratios. But note two things. The first is

that, in the United States, the riskless rate is lower than the growth rate despite an existing debt to GDP

ratio around 80%, and a large intergenerational transfer system. If there were no public debt nor social

security system at all, presumably all interest rates, including the riskless rate would be substantially

VOL. VOLUME NO. ISSUE DEBT AND RATES 25

The underlying parameters in both cases are calibrated so as to fit values of ER

and ERf absent debt corresponding to -1% for the annual safe rate, and 2% for

the annual risky rate.

Failure is defined as the point where the safe rate becomes sufficiently large

and positive (so that the probability that debt does not explode becomes very

small—depending on the unlikely realisation of successive large positive shocks

which would take the safe rate back below the growth rate); rather arbitrarily,

I choose the threshold to be 1% at an annual rate. If the debt rollover fails, I

assume, again arbitrarily and too strongly, that all debt is paid back through a

tax on the young. This exaggerates the effect of failure on the young in that

period, but is simplest to capture.28

In the linear case, the higher debt and lower capital accumulation have no effect

on the risky rate, and a limited effect on the safe rate, and all paths show declining

debt. Four periods out (100 years), all of them have lower debt than at the start.

Figure 11. : Linear production function. Debt evolutions under a debt rollover

D0= 16.875% of endowment

en

-�

rn ,,......_ <l)l:f:.... '----' � en

�

Debt Share of Savings, Linear OLG With Uncertainty

ER=2% ERf=-1% initdebt =16.875%

20 -----,f--------------'--------------'-------------'---------------+-

18

16

14

12

10

8

6-----,f-------------�------------r---------------r---------------+-

0 25 50

Time (year)

75 100

In the Cobb-Douglas case, with the same values of ER and ERf absent debt,

bad shocks, which lead to higher debt and lower capital accumulation, lead to

increases in the risky rate, and by implication, larger increases in the safe rate.

The result is that, for the same sequence of shocks, now 5% of paths, fail over the

lower (a point made by Larry Summers (2018)). Thus, the simulation is in effect looking at additional

increases in debt, starting from current levels. The second point is that, under a debt rollover, current

debt is not offset by future taxes, and thus is fully net wealth. This in turn implies that it has a strong

effect on capital accumulation, and in turn on both the risky and the safe rate.

28An alternative assumption would be default on the debt. This however would make public debt

risky throughout, and lead to a much harder problem to solve.

26 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

Figure 12. : Cobb-Douglas production function. Debt evolutions under a debt

rollover D0= 16.875% of endowment

)

Debt Share of Savings, CB OLG With Uncertainty

ER=2% ERf=-1% initdebt =16.875%

35 -----,f--------------'--------------'-------------'---------------+-

en b.()

�

-�

rn 4-. o30

25

<l) i:f: 20 .... '----' � en ..., ..0 <l) � 15

10

5-----,f-------------�------------r--------------r---------------+-

0 25 50

Time (year)

75 100

first four periods—100 years if we take a period to be 25 years. The failing paths

are represented in red.

Second, consider welfare effects: Relative to a pay-as-you-go scheme, debt

rollovers are much less attractive. Remember the two effects of an intergenerational transfer. The first comes from the fact that people receive a rate of return

of 1 on the transfer, a rate which is typically higher than R

f

t

. In a debt rollover,

they receive a rate of return of only R

f

t−1

, which is typically less than one. At

the margin, they are indifferent to holding debt or capital. There is still an inframarginal effect, a consumer surplus (taking the form of a less risky portfolio, and

thus less risky second period consumption), but the positive effect on welfare is

smaller than in the straight transfer scheme. The second effect, due to the change

in wages and rate of return on capital, is still present, so the net effect on welfare,

while less persistent as debt decreases over time, is more likely to be negative.

These effects is shown in Figures (13) and (14), which show the average welfare

effects of successful and unsuccessful debt rollovers, for the linear and the CobbDouglas case.

In the linear case, debt rollovers typically do not fail and welfare is increased

throughout. For the generation receiving the initial transfer associated with debt

issuance, the effect is clearly positive and large. For later generations, while they

are, at the margin, indifferent between holding safe debt or risky capital, the

inframarginal gains (from a less risky portfolio) imply slightly larger utility. But

the welfare gain is small (equal initially to about 0.3% and decreasing over time),

VOL. VOLUME NO. ISSUE DEBT AND RATES 27

Figure 13. : Linear production function. Welfare effects of a debt rollover D0=

18% of endowment

Linear OLG With Uncertainty

ER=2% ERf=-1% initdebt =16.875%

0.6 -t-------------�------------�------------�------------+--

0.5

0.4

� �0.3

0.1

0-t-------------�------------�------------�------------+--

0 25 50

Time (year)

75 100

Figure 14. : Cobb-Douglas production function. Welfare effects of a debt rollover

D0= 18% of endowment

...., i;

"::)

0 '"' (1) "

0 ...., (1)

,;:;....,

al

o:l -

� ...

...., ;,:.;

�....,

;:I

(1) ...., o:l

b.O (1) '"' b.O

b.O

�

CB OLG With Uncertainty

ER=2% ERf=-1% initdebt =16.875%

4-----,f--------------'--------------'-------------'---------------+-

2

0

-2

-4

-6

-8

-10 -----,f--------------r--------------r--------------r---------------+-

0 25 50

Time (year)

75 100

28 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

compared to the initial welfare effect on the young from the initial transfer, (7%).

In the Cobb-Douglas case however, this positive effect is more than offset by

the price effect, and while welfare still goes up for the first generation (by 3%),

it is typically negative thereafter. In the case of successful debt rollovers, the

average adverse welfare cost decreases as debt decreases over time. In the case

of unsuccessful rollovers, the adjustment implies a larger welfare loss when it

happens.29

If we take the Cobb-Douglas example to be more representative, are these Ponzi

gambles—as Ball, Elmendorf and Mankiw have called them—worth it from a

welfare viewpoint? This clearly depends on the relative weight the policy maker

puts on the utility of different generations. If the social discount factor it uses

is close to one, then debt rollovers under the conditions underlying the Cobb

Douglas simulation are likely to be unappealing, and lead to a social welfare loss.

If it is less than one, the large initial increase in utility may well dominate the

average utility loss later.

V. Earnings versus marginal products

The argument developed in the previous two sections showed that the welfare

effects of an intergenerational transfer—or an increase in debt, or a debt rollover—

depend both on how low the average safe rate and how high the average marginal

product of capital are relative to growth rate. The higher the average marginal

product of capital, for a given safe rate, the more adverse the effects of the

transfer. In the simulations above (reiterating the caveats about how seriously

one should take the quantitative implications of that model), the welfare effects

of an average marginal product far above the growth rate typically dominated

the effects of an average safe slightly below the growth rate, implying a negative

effect of the transfer (or of debt) on welfare.

Such a configuration would seem to be the empirically relevant one. Look at

Figure (15). The blue line gives the evolution of the ratio of pre-tax earnings of

U.S. non-financial corporations, defined as their net operating surplus, to their

capital stock measured at replacement cost, since 1950. Note that, while this

earnings rate declined from 1950 to the late 1970s, it has been rather stable since

then, around a high 10%, so 6 to 8% above the growth rate. (see Appendix E for

details of construction and sources)

Look at the red line however. The line gives the evolution of the ratio of the

same earnings series, now to the market value of the same firms, constructed as

the sum of the market value of equity plus other liabilities minus financial assets.

Note how it has declined since the early 1980s, going down from roughly 10%

29Note that the cost of adjustments when a rollover is unsuccessful increases over time. This is because

the average value of debt, conditional on exceeding the threshold, increases for some time. Initially, only

a few paths reach the threshold, and the value of debt, conditional on exceeding the threshold, is very

close to the threshold. As the distribution becomes wider, the value of debt, conditional on crossing

the threshold increases. As the distribution eventually stabilizes, the welfare cost also stabilizes. In the

simulation, this happens after approximately 6 periods, or 150 years.

VOL. VOLUME NO. ISSUE DEBT AND RATES 29

then to about 5% today. Put another way, the ratio of the market value of firms

to their measured capital at replacement cost, known as Tobin’s q, has roughly

doubled since the early 1980s, going roughly from 1 to 2.

There are two ways of explaining this diverging evolution; both have implications for the average marginal product of capital, and, as result, for the welfare

effects of debt.30 Both have been and are the subject of much research, triggered

by an apparent increase in markups and concentration in many sectors of the U.S.

economy (e.g. DeLoecker and Eeckhout (2017), Guti`errez and Philippon (2017),

Philippon (2018), Barkai (2018), Farhi and Gouriou (2018).)

0

2

4

6

8

10

12

14

16

18

1950 1953 1956 1959 1962 1965 1968 1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 2016

Profit over capital at replacement cost Profit over market value

Figure 15. : Earnings over replacement cost, Earnings over market value since

1950

The first explanation is unmeasured capital, reflecting in particular intangible

capital. To the extent that the true capital stock is larger than the measured

capital stock, this implies that the measured earnings rate overstates the true

rate, and by implication overstates the marginal product of capital. A number

of researchers have explored this hypothesis, and their conclusion is that, even if

the adjustment already made by the Bureau of Economic Analysis is insufficient,

intangible capital would have to be implausibly large to reconcile the evolution

of the two series: Measured intangible capital as a share of capital has increased

from 6% in 1980 to 15% today. Suppose it had in fact increased by 25%. This

would only lead to a 10% increase in measured capital, far from enough to explain

the divergent evolutions of the two series.31

30There is actually a third way, which is that stock prices do not reflect fundamentals. While this is

surely relevant at times, this is unlikely to be true over a 40 year period.

31Further discussion can be found in Barkai 2018.

30 THE AMERICAN ECONOMIC REVIEW MONTH YEAR

The second explanation is increasing rents, reflecting in particular the increasing

relevance of increasing returns to scale and increased concentration.32. If so, the

earnings rate reflects not only the marginal product of capital, but also rents. The

market value of firms reflects not only the value of capital but also the present

value of rents. If we take all of the increase in the ratio of the market value of

firms to capital at replacement cost to reflect an increase in rents, the doubling

of the ratio implies that rents account for roughly half of earnings.33

As for many of the issues raised in this lecture, many caveats are in order, and

they are being taken on by current research. Movements in Tobin’s q, the ratio

of market value to capital, are often difficult to explain.34 Yet, the evidence is

fairly consistent with a decrease in the average marginal product of capital, and

by implication, a smaller welfare cost of debt.

VI. A broader view. Arguments and counterarguments

So far, I have considered the effects of debt when debt was used to finance

intergenerational transfers in a full employment economy. This was in order to

focus on the basic mechanisms at work. But it clearly did not do justice to the

potential benefits of debt finance, nor does it address other potential costs of

debt left out of the model. The purpose of this last section is to discuss potential

benefits and potential costs. As this touches on many aspects of the economy and

many lines of research, it is informal, more in the way of remarks and research