http://www.asyura2.com/16/senkyo200/msg/509.html

| Tweet |

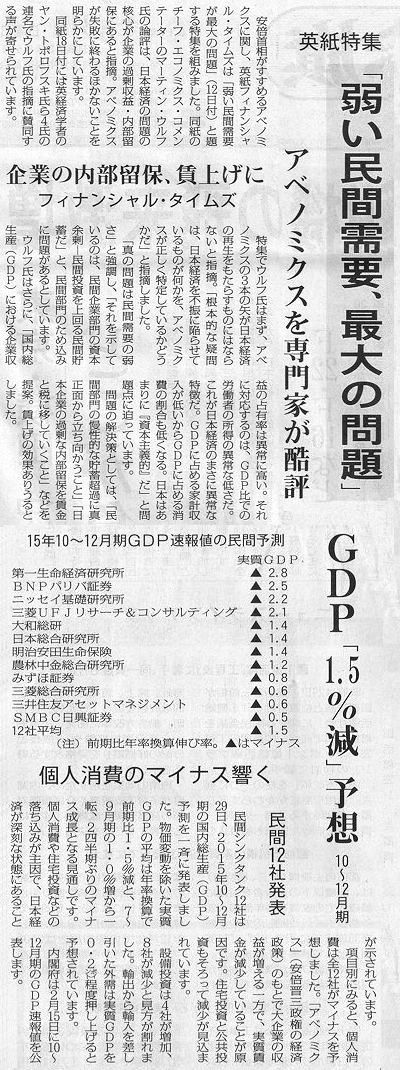

個人消費のマイナス響く(しんぶん赤旗)

(「しんぶん赤旗」2016年01月31日付から)

ソースであるフィナンシャル・タイムズの英文記事(電子版では1月11日付)はこちら ⇒

http://www.ft.com/intl/cms/s/2/65b7ebba-824b-11e5-a01c-8650859a4767.html#axzz3yiuQ7vTF

Of the three, monetary policy has been shot most aggressively. Under the policy of quantitative and qualitative easing adopted in April 2013, the Bank of Japan has increased its balance sheet from 34 per cent of gross domestic product at the end of the first quarter of 2013 to 73 per cent two and a half years later. Relative to GDP, the BoJ’s balance sheet dwarfs those of the Federal Reserve, the European Central Bank and the Bank of England (see charts).

The arrow of fiscal policy has, however, not been shot. According to the International Monetary Fund, Japan had a cyclically adjusted fiscal easing of only 0.4 per cent of gross domestic product in 2013. The cyclically adjusted fiscal deficit tightened by 1.3 per cent of GDP in 2014, largely because of a misconceived jump in the rate of consumption tax, from 5 to 8 per cent, in the spring of 2014. A comparable tightening is forecast for 2015.

Finally, structural reforms have been quite modest. The government has reformed agricultural co-operatives. It has also agreed to liberalisation in the Trans-Pacific Partnership (TPP), the US-led trade pact. It has made modest progress on energy and tax reform. Improvement in opportunities for women is moving at a glacial pace. Increasing immigration remains largely taboo. The labour market has entrenched differences between permanent and temporary workers.

What have been the results so far? On inflation, Japan has made modest progress. In the year to October 2015, core inflation (all items, less food, alcoholic beverages and energy) was just 0.8 per cent, still far below the 2 per cent target. On output, the outcome is also disappointing. Real GDP rose 1.7 per cent over the year to the third quarter of 2015. Yet, between the end of 2012 when Mr Abe became prime minister and the third quarter of 2015, the economy grew a mere 2.4 per cent in real terms, and was only the same size as the first quarter in 2008.

A fundamental question is whether Abenomics has correctly identified what is ailing the Japanese economy.

The labour market, for example, performs excellently. The unemployment rate was just 3.1 per cent in October 2015. When one allows for the shrinking labour force, the growth performance is not bad either. Trend annual growth of GDP per person of working age was 1.5 per cent between 2000 and 2010, and then 2 per cent between 2010 and 2015. Both rates were the highest in the Group of Seven leading high-income countries.

According to the IMF, Japan’s GDP per head at purchasing power parity was only 69 per cent of US levels in 2014, ahead only of Italy within the G7. Radical reform might generate faster catch-up growth. But it would be remarkable if Japan were to sustain annual growth of GDP per worker at more than around 1.5 per cent. Without mass immigration, even this would imply potential annual growth of around 1 per cent, well below the 2 per cent envisaged. According to the BoJ, the potential annual rate of growth rate is now only 0.5 per cent.

Supply, then, is not Japan’s problem — or, if it is, it is because of the shrinkage of the labour force. The real problem is the weakness of private demand. The indicator of that is the enormous private sector financial surpluses — the excess of private savings over private investment. This surplus has oscillated between 5 per cent and 14 per cent of GDP since the mid-1990s.

A country with a declining population does not need to build more houses — the main investment by households. Household investment has fallen from 7 per cent of GDP in the early 1990s to below 4 per cent. This fall has offset the decline in household savings rates. The result has been a chronic household financial surplus.

The corporate sector financial surplus is even bigger. It averaged 7 per cent of GDP between 2001 and 2013, and, at its peak, in 2009 and 2010, reached 9 per cent. This corporate surplus is due to strong corporate savings, which averaged 22 per cent of national income since the early 2000s, and mildly declining corporate gross investment, which averaged 14 per cent of GDP over the same period. But this investment rate is still remarkably high by the standards of other G7 countries.

The counterpart borrower has been the government. The ratio of gross public debt to GDP jumped from 67 per cent in 1990 to 246 per cent in 2015, while the ratio of net debt increased from 13 to 126 per cent. Yet, despite sustained fiscal deficits and near-zero short-term interest rates, the mild deflation has not been durably eliminated.

The BoJ’s purchases of low-yielding Japanese government bonds (JGBs) are highly unlikely to eliminate the private sector’s huge financial surpluses.

So what is to be done? A first option is to continue with today’s large fiscal deficits and central bank purchases of JGBs, in the hope that the surpluses of the private sector will soon disappear. Unfortunately, this seems unlikely. If so, the fiscal deficits cannot be safely eliminated. This policy will end up as permanent monetisation of deficits.

A second option is to admit that the policy is monetisation. The BoJ would agree with the government on monetary financing or on transfers to households. Moreover, given the public sector debt overhang in Japan, a new and higher inflation target could also be set, with a view to lowering the debt burden.

A third option is to impose fiscal austerity. Some will argue that the private sector would recognise the improved solvency of the state and so cut back on excess savings. In Japan, this argument looks implausible. The result is more likely to be a deep recession.

A fourth option is to export the excess savings via a bigger current account surplus. This is exactly what Germany has done. The real effective exchange rate has depreciated by some 30 per cent since Mr Abe became prime minister. To do this, the BoJ could purchase foreign bonds. Alternatively, the government could set up a sovereign wealth fund financed by the sale of JGBs. Yet such policies, if pursued on a large enough scale, would worsen global imbalances. That would be unpopular abroad.

A fifth option is to attack the private sector’s chronic savings surplus head on. To do that, one must first recognise that Japan saves too much. So raising taxes on consumption is the opposite of what should be done.

Shifting Japan’s excess corporate retained earnings into wages and taxes would go a long way towards eliminating the structural savings surplus. One could slash depreciation allowances, for example. Reform of corporate governance might also increase the distribution of corporate earnings. Yet another possibility would be to force up wages.

It is, in brief, “not the supply, but the demand, stupid”. The structural savings surpluses of the private and, in particular, of the corporate sectors have driven the government into its deficits and growing debts. Abenomics does not recognise this underlying reality. Japan must offset the private surpluses, export them or eliminate them. This is the dominant challenge.

The first step is to recognise the core problem — one of insufficient private demand. Only then can it be solved.

Is Abenomics bound to fail?

Join the live discussion via Facebook on January 13 at 1pm GMT

|

|

|

|

投稿コメント全ログ コメント即時配信 スレ建て依頼 削除コメント確認方法

▲上へ ★阿修羅♪ > 政治・選挙・NHK200掲示板 次へ 前へ

|

|

スパムメールの中から見つけ出すためにメールのタイトルには必ず「阿修羅さんへ」と記述してください。

スパムメールの中から見つけ出すためにメールのタイトルには必ず「阿修羅さんへ」と記述してください。すべてのページの引用、転載、リンクを許可します。確認メールは不要です。引用元リンクを表示してください。